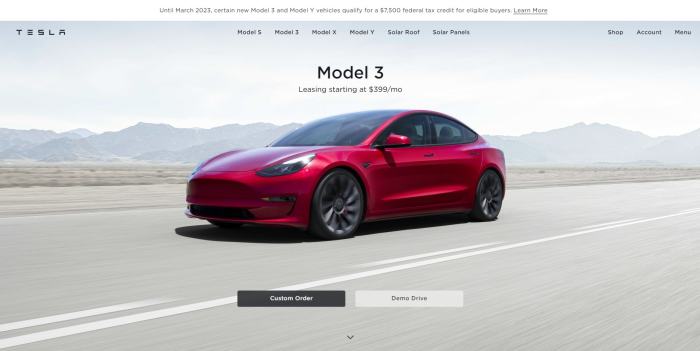

Tesla Model 3 leasing option rumor: Is it real, or just another electric car whisper swirling through the internet? The whispers started somewhere, maybe a forum post, a cryptic tweet, or a leaked internal memo. From there, it spread like wildfire across social media, fan blogs, and even some news outlets. This rumor has everyone buzzing – potential buyers, Tesla investors, and even competitors are all wondering: will Tesla finally offer a leasing option for its popular Model 3?

This article dives deep into the heart of this electric enigma, tracing the rumor’s origins, analyzing the potential leasing details (if any exist), and exploring the impact on consumer perception, Tesla’s official response (or lack thereof), and the broader implications for Tesla’s business strategy. We’ll dissect the online chatter, compare rumored terms to competitor offerings, and even imagine a hypothetical marketing campaign should Tesla decide to officially launch a Model 3 leasing program. Get ready to unravel the truth (or lack thereof) behind this electrifying rumor.

Rumor Origins and Spread

The recent buzz surrounding a potential Tesla Model 3 leasing option, while ultimately debunked, offers a fascinating case study in how rumors spread in the digital age. Its rapid dissemination across various online platforms highlights the power of social media and online forums in shaping public perception, even when the information is inaccurate. The rumor’s lifecycle, from initial whispers to widespread discussion and eventual clarification, provides valuable insight into the dynamics of online information sharing.

The initial source of the Tesla Model 3 leasing rumor remains somewhat elusive. Pinpointing the absolute origin is difficult due to the decentralized nature of online communication. However, anecdotal evidence suggests the rumor may have started within niche Tesla owner forums, possibly stemming from misinterpretations of internal Tesla communications or even a cleverly crafted hoax. The lack of a single, identifiable originator makes tracing its precise beginning challenging. It’s likely the rumor gained traction through a snowball effect, with each re-posting and re-interpretation amplifying its reach.

Rumor Dissemination Across Online Platforms

The rumor’s spread was rapid and widespread. Initially confined to dedicated Tesla online forums, the news quickly migrated to larger social media platforms like Twitter and Facebook. Posts discussing the potential leasing program gained significant traction, fueled by the inherent excitement surrounding Tesla products and the general interest in automotive news. Screenshots of purported internal documents or emails, often lacking proper verification, were shared extensively, further bolstering the rumor’s credibility in the eyes of many. News aggregators and even some smaller news websites picked up the story, contributing to its wider dissemination among a less-informed audience.

Analysis of Language Used

The language employed in the initial reports and subsequent discussions varied greatly. Early posts in forums often displayed a mixture of cautious optimism and speculative excitement. Phrases like “heard through the grapevine” or “unconfirmed reports suggest” were common, indicating a degree of uncertainty. As the rumor spread, the language became more assertive, with some posts presenting the leasing option as a confirmed fact. The shift in tone is significant, illustrating how the narrative evolved as it was passed along and amplified. The use of emotionally charged language, such as “game-changer” or “revolutionary,” further intensified the rumor’s impact.

Timeline of the Rumor’s Evolution

A precise timeline is difficult to construct due to the decentralized nature of the information spread. However, a general timeline can be estimated. The rumor likely originated within niche online forums within a week or two before its appearance on larger social media platforms. Within 24-48 hours, the rumor had spread widely across Twitter and Facebook. The major news outlets picked up the story within a few days, leading to a peak in discussion. Finally, after approximately one week, Tesla officially addressed the rumor, clarifying that no such leasing program was planned, effectively ending the speculation. This timeline, while approximate, demonstrates the speed and reach of online rumors.

Analysis of Leasing Program Details (If any exist)

The recent buzz surrounding a potential Tesla Model 3 leasing program lacks concrete details. However, based on snippets of information circulating online, we can speculate on what such a program might entail and compare it to existing Tesla financing and competitor offerings. The absence of official confirmation necessitates a cautious approach, relying heavily on informed estimations and comparisons with established market practices.

Rumors suggest a potential Model 3 lease might offer competitive monthly payments, potentially attracting a wider customer base hesitant to commit to a large purchase price. However, the lack of specifics regarding down payments, mileage limits, and lease terms leaves significant room for interpretation. We can, however, extrapolate potential scenarios based on Tesla’s current financing options and those offered by similar electric vehicle manufacturers.

Comparison of Rumored Tesla Model 3 Lease with Competitor Offerings

To illustrate potential leasing terms, let’s construct a hypothetical comparison table. This table uses estimated figures based on industry trends and existing Tesla and competitor financing options. It’s crucial to remember that these are speculative figures and should not be considered official offerings. The actual terms of a Tesla Model 3 lease, should it materialize, could vary significantly.

| Vehicle | Monthly Payment (Estimate) | Down Payment (Estimate) | Mileage Limit (Annual) |

|---|---|---|---|

| Tesla Model 3 (Rumored Lease) | $500 – $700 | $5,000 – $10,000 | 10,000 – 15,000 miles |

| Ford Mustang Mach-E (Lease Example) | $600 – $800 | $4,000 – $6,000 | 12,000 miles |

| Chevrolet Bolt EUV (Lease Example) | $400 – $600 | $3,000 – $5,000 | 10,000 miles |

| Hyundai Ioniq 5 (Lease Example) | $550 – $750 | $4,500 – $7,000 | 12,000 – 15,000 miles |

The introduction of a competitive leasing program could significantly impact Tesla’s sales and market share. By lowering the barrier to entry for potential customers, leasing could attract buyers who might otherwise be deterred by the high upfront cost of purchasing a Tesla. This is particularly relevant in markets where leasing is a more prevalent financing method. For example, the success of leasing programs for other luxury and electric vehicle brands demonstrates a clear preference for this financing option among consumers.

Increased accessibility through leasing could expand Tesla’s customer base, potentially leading to a surge in sales and a strengthening of its market position. However, the specific impact will depend on the details of the leasing program, including the monthly payment, down payment requirements, and mileage limits. A poorly structured program could, conversely, negatively affect Tesla’s profitability or even cannibalize sales from outright purchases.

Impact on Consumer Perception

The rumor of a Tesla Model 3 leasing option has the potential to significantly shift consumer perception and buying behavior. Whether this impact is ultimately positive or negative for Tesla depends on several factors, including the specifics of any eventual leasing program and the overall economic climate. The speed and reach of online discussion surrounding this rumor highlight the importance of managing public perception in the age of social media.

The rumor’s effect on consumer interest is multifaceted. While some might view leasing as a more accessible entry point to Tesla ownership, others might interpret it as a sign of waning demand for the Model 3, potentially leading to decreased purchase interest. This ambiguity creates a complex scenario where the ultimate impact is difficult to predict with certainty.

Consumer Reactions and Online Comments

The online discourse surrounding the potential Model 3 leasing program reveals a mixed bag of reactions. Many potential buyers have expressed excitement, viewing leasing as a lower-risk way to experience Tesla technology. Comments on forums and social media platforms like Reddit and Twitter frequently mention the potential for lower monthly payments and reduced upfront costs as major selling points. Conversely, some long-time Tesla enthusiasts have voiced concerns that a leasing program might devalue their existing Model 3 vehicles, leading to negative sentiment. Others are skeptical, questioning whether Tesla’s leasing terms will be competitive with established automakers. For example, a common thread in online discussions is the comparison of Tesla’s potential lease rates to those offered by other electric vehicle manufacturers. Some users pointed out that unless Tesla offers exceptionally favorable terms, the leasing option might not significantly boost sales.

Potential Influence on Tesla’s Stock Price

The rumor’s impact on Tesla’s stock price is difficult to isolate from other market factors. However, a well-structured leasing program could potentially boost Tesla’s stock price by expanding its customer base and increasing sales volume. Conversely, a poorly designed or poorly received leasing program could negatively affect investor confidence, leading to a stock price decline. For example, if the lease terms are perceived as unfavorable or if the program faces logistical challenges, this could negatively impact investor sentiment. Conversely, a successful leasing program that demonstrably increases sales could positively influence Tesla’s stock valuation, aligning with past examples where positive sales figures have correlated with stock price increases for other companies. The overall effect will depend on the market’s interpretation of the leasing program’s success and its long-term implications for Tesla’s profitability and market share.

Summary of Impacts: Positive and Negative, Tesla model 3 leasing option rumor

Let’s summarize the potential impacts of the Tesla Model 3 leasing rumor:

- Positive Impacts: Increased accessibility for potential buyers, potentially boosting sales and positively influencing Tesla’s stock price if the program is well-received and effectively implemented. This could lead to increased brand visibility and market share.

- Negative Impacts: Potential devaluation of existing Model 3 vehicles, negative perception among some loyal Tesla customers, potentially negative impact on stock price if the program is poorly executed or perceived as unfavorable, increased competition within the EV leasing market. This could lead to decreased profit margins and diluted brand image if not carefully managed.

Potential Implications for Tesla’s Business Strategy: Tesla Model 3 Leasing Option Rumor

The persistent rumor of a Tesla Model 3 leasing program has significant implications for Tesla’s overall business strategy. Analyzing the potential reasons behind such a move, along with its potential benefits and drawbacks, reveals a complex picture of financial maneuvering and market positioning. The decision to lease or not lease the Model 3 isn’t simply a matter of offering another payment option; it’s a strategic choice that reflects Tesla’s long-term goals and how it aims to navigate the ever-evolving automotive landscape.

Tesla’s current business model, heavily reliant on direct sales and a premium brand image, could be impacted by introducing a leasing program. The implications extend beyond simple finance; they reach into Tesla’s brand perception, its sales strategy, and its relationship with its customer base.

Reasons for and Against Introducing a Leasing Option

Tesla might introduce a leasing program to increase accessibility to the Model 3, attracting a wider range of buyers who might be hesitant to commit to a large upfront purchase. This could boost sales volume, particularly in price-sensitive markets. Conversely, leasing might dilute the brand’s exclusive image, attracting customers less committed to the Tesla brand and potentially impacting resale values. Furthermore, managing a leasing program requires significant logistical and financial investment, potentially diverting resources from other key areas of the business. For example, a successful leasing program necessitates a robust infrastructure for managing lease agreements, vehicle maintenance, and end-of-lease processing. This contrasts with Tesla’s current focus on expanding its Supercharger network and developing new vehicle technologies.

Benefits and Drawbacks of a Tesla Model 3 Leasing Program

Offering a leasing program could significantly increase the affordability of the Model 3, attracting a broader customer base and boosting sales volume. Lower monthly payments could make the vehicle more accessible to younger buyers or those with tighter budgets. However, leasing might reduce Tesla’s overall revenue per vehicle sold, as the company would receive payments over time rather than a single, large upfront payment. This reduction in immediate revenue could impact Tesla’s short-term financial performance, potentially affecting its ability to invest in research and development or expansion projects. Moreover, residual values of leased vehicles need careful management, as a decline in residual value could negatively impact the profitability of the leasing program. This is especially relevant considering the rapid pace of technological advancements in the automotive industry.

Alignment with Tesla’s Overall Business Goals

A leasing program could potentially align with Tesla’s goal of mass-market adoption by broadening the appeal of the Model 3. However, it might contradict Tesla’s strategy of maintaining a premium brand image, as leasing is often associated with more mainstream brands. The success of a leasing program would depend on Tesla’s ability to balance these competing goals and manage the potential risks associated with a shift from a direct sales model. For instance, carefully managing the terms of the lease, including mileage limits and wear-and-tear policies, would be crucial in protecting Tesla’s brand and vehicle values. A poorly managed leasing program could damage the brand’s reputation and lead to financial losses.

Hypothetical Marketing Campaign for a Tesla Model 3 Leasing Program

A hypothetical marketing campaign could emphasize the flexibility and affordability of leasing, highlighting the low monthly payments and the ability to upgrade to newer models after the lease term. The campaign could target a younger demographic, using social media and digital marketing channels to reach potential customers. The tagline could be something like: “Drive the Future, Your Way. Lease a Model 3.” The campaign would showcase the sleek design and advanced technology of the Model 3, emphasizing its eco-friendly credentials. A series of short, visually appealing videos could depict everyday scenarios showcasing the convenience and style of owning a Model 3 through leasing. The campaign would also highlight Tesla’s existing charging infrastructure and customer service support, reassuring potential lessees about the ease of ownership. The emphasis would be on creating a seamless and positive customer experience.

So, is the Tesla Model 3 leasing option rumor fact or fiction? The answer, for now, remains elusive. While the rumor itself has sparked considerable online discussion and speculation, Tesla’s official silence adds to the mystery. Whether the company ultimately decides to offer leasing remains to be seen, but one thing’s for sure: this rumor highlights the intense consumer interest in the Model 3 and the significant impact even unsubstantiated claims can have on a company’s image and market perception. The electric car world waits with bated breath.

Informatif Berita Informatif Terbaru

Informatif Berita Informatif Terbaru