Visa mastercard transactions more expensive u s – Visa Mastercard transactions more expensive US? Yeah, we’ve all felt that pinch. From everyday coffee runs to those big online splurges, it seems like those little plastic rectangles are costing us more than ever. But why? Is it just sneaky merchant fees, or is there a bigger picture at play? This deep dive unpacks the hidden costs behind those Visa and Mastercard transactions, revealing the surprising reasons why they’re draining your wallet.

We’ll break down the complex world of merchant fees, interchange fees, and those pesky foreign transaction fees. We’ll compare Visa and Mastercard to other payment options, exploring why some methods might save you serious cash. And most importantly, we’ll equip you with the knowledge to make smarter choices and keep more money in your pocket. Get ready to become a payment processing pro!

Interchange Fees

Interchange fees are a crucial, yet often misunderstood, component of the credit and debit card payment system. These fees, charged by card networks like Visa and Mastercard to banks for processing transactions, significantly impact the overall cost of goods and services for consumers. Understanding their structure and influence is key to navigating the complexities of modern commerce.

Interchange fees are essentially a percentage of the transaction value plus a fixed amount. This structure ensures that the fee scales with the purchase amount, but also includes a base cost for processing the payment regardless of size. The exact fee varies depending on several factors, which we’ll explore further. While seemingly small on individual transactions, these fees accumulate significantly across millions of daily transactions, influencing the price consumers pay.

Interchange Fee Structure for Visa and Mastercard

Visa and Mastercard’s interchange fee structures are complex and proprietary, not publicly released in their entirety. However, it’s understood that they vary based on factors like the type of card (credit, debit, prepaid), the merchant category code (MCC), and the transaction type (in-person, online). Generally, credit card transactions tend to have higher interchange fees than debit card transactions, reflecting the higher risk associated with extending credit. Furthermore, certain merchant categories, deemed higher-risk, often face higher interchange fees. For instance, a cash-advance transaction would likely attract a higher fee than a standard purchase. This complexity makes it challenging to pinpoint an exact fee for any given transaction.

Comparison with Other Card Networks

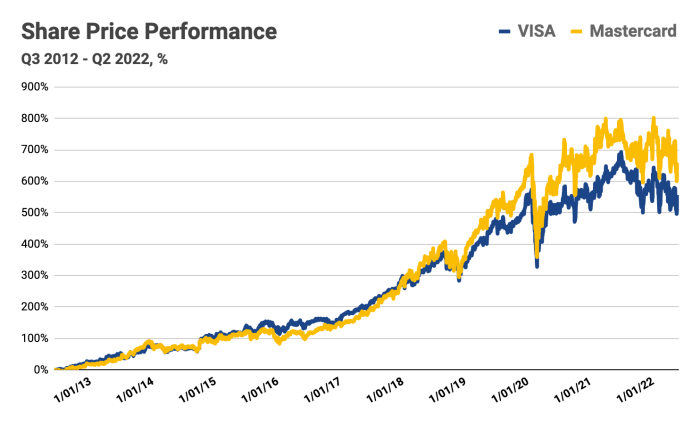

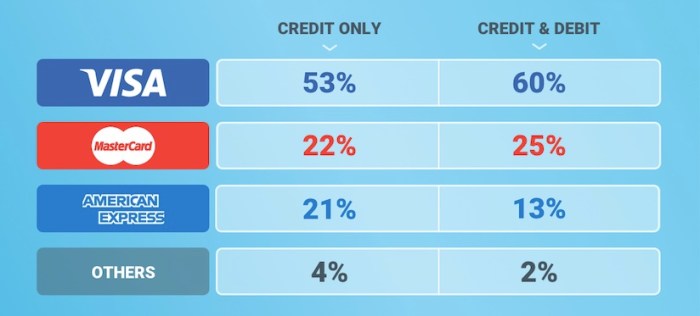

While Visa and Mastercard dominate the market, other card networks like American Express and Discover also operate with their own interchange fee structures. These structures are similarly complex and proprietary, but generally, American Express tends to have higher interchange fees than Visa and Mastercard, partly due to its higher acceptance rates and premium card offerings. Discover’s fees usually fall somewhere between American Express and Visa/Mastercard. The differences in fees between networks often reflect their respective market positions, risk profiles, and value propositions to merchants and consumers. The lack of complete transparency in fee structures makes direct comparisons difficult, relying largely on industry reports and estimates.

Impact on the Cost of Goods and Services, Visa mastercard transactions more expensive u s

The cumulative effect of interchange fees is substantial. These fees are ultimately passed on to consumers through higher prices. Merchants factor interchange fees into their pricing strategies, subtly increasing the cost of goods and services to offset the processing costs. This is particularly relevant for smaller businesses with lower profit margins, where the impact of interchange fees can be disproportionately felt. The ripple effect is that consumers bear the burden of these fees indirectly through inflated prices. For example, a small coffee shop might increase the price of its lattes by a few cents to account for the interchange fees associated with card payments.

Factors Influencing Interchange Fees

Several factors influence the interchange fees charged by Visa and Mastercard. Understanding these factors provides insight into the complexities of this system.

- Card Type: Credit cards typically have higher fees than debit cards due to the inherent credit risk.

- Merchant Category Code (MCC): High-risk businesses (e.g., casinos, online retailers) may face higher fees.

- Transaction Type: Cash advances or other non-standard transactions generally incur higher fees.

- Transaction Value: While a percentage is involved, a fixed fee component often exists, impacting smaller transactions more.

- Network Brand: The specific network (Visa, Mastercard, Amex, etc.) influences the fee, with some networks charging more than others.

- Negotiation Power: Larger merchants often negotiate lower interchange fees due to their volume.

Consumer Protection and Regulations: Visa Mastercard Transactions More Expensive U S

The US regulatory landscape surrounding Visa and Mastercard transactions is a complex web of federal and state laws designed to protect consumers from unfair practices and excessive fees. While the aim is to foster competition and prevent anti-competitive behavior, the effectiveness of these regulations in controlling transaction costs remains a subject of ongoing debate. The interplay between consumer protection, network dominance, and the intricacies of interchange fees creates a dynamic environment constantly shaped by legislative action and court rulings.

The primary federal agency overseeing the credit card industry is the Consumer Financial Protection Bureau (CFPB). This agency has broad authority to regulate various aspects of consumer financial products and services, including credit cards. State laws also play a significant role, often addressing specific issues like interest rates, late fees, and disclosure requirements. This patchwork of regulations contributes to the complexity of the system.

Consumer Protection Laws Related to Credit Card Fees

Several consumer protection laws directly impact credit card fees. The Truth in Lending Act (TILA) mandates clear disclosure of all fees and interest rates to consumers before they enter into a credit agreement. This ensures consumers are aware of the total cost of credit before committing. The Fair Credit Billing Act (FCBA) provides consumers with a process to dispute inaccurate or unauthorized charges on their credit card statements. This protects consumers from fraudulent activity and billing errors. The Dodd-Frank Wall Street Reform and Consumer Protection Act further strengthened consumer protections by granting the CFPB enhanced oversight of the credit card industry. These regulations, while aiming to provide consumer protection, haven’t completely addressed the issue of high transaction costs, especially regarding interchange fees.

Effectiveness of Current Regulations in Controlling Transaction Costs

The effectiveness of current regulations in controlling transaction costs is a matter of ongoing debate. While laws like TILA and FCBA offer significant consumer protections regarding disclosure and dispute resolution, their impact on the overall level of transaction costs is less direct. The complexity of interchange fee structures and the market power of Visa and Mastercard often make it challenging for regulators to effectively control these fees. Some argue that current regulations are insufficient to prevent anti-competitive practices and that further reforms are needed to promote greater transparency and competition in the payment processing industry. For example, while the CFPB can investigate and take action against unfair or deceptive practices, it hasn’t completely curbed the upward pressure on interchange fees.

Transparency in Fee Structures and Consumer Benefits

Greater transparency in fee structures would significantly benefit consumers. Currently, the complexity of interchange fees and the lack of readily available information make it difficult for consumers to understand the true cost of their transactions. Increased transparency would empower consumers to make informed choices about which credit cards and payment methods to use, potentially driving competition among issuers and processors. This could lead to lower overall transaction costs and a more efficient payment system. Imagine a world where consumers could easily compare the fees associated with different cards and merchants, making rational choices based on cost and convenience. This improved understanding could lead to more efficient market forces and greater consumer control over their financial decisions.

So, are Visa and Mastercard transactions really costing you more in the US? The answer, unfortunately, is often yes. From the intricate web of merchant and interchange fees to the hidden costs of international transactions, the system is far from transparent. But understanding these mechanisms empowers you. By choosing alternative payment methods, negotiating with merchants, and staying aware of the fees, you can take control of your spending and keep more of your hard-earned cash. It’s time to ditch the blind swipe and start making informed decisions about your money.

Informatif Berita Informatif Terbaru

Informatif Berita Informatif Terbaru